Life Insurance Company Transparency [New Texas Bill]

Newest Texas Bill Passed Requires More Transparency From Life Insurance Companies

Life insurance consumers and each Life Insurance Company may be better informed of changes in their premiums if a bill passed unanimously by the Texas House of Representatives this spring becomes law. Texas House Bill 207 sets new disclosure standards for certain types of premium increases, and if it is codified the bill will become law in the state on Jan. 1, 2020.

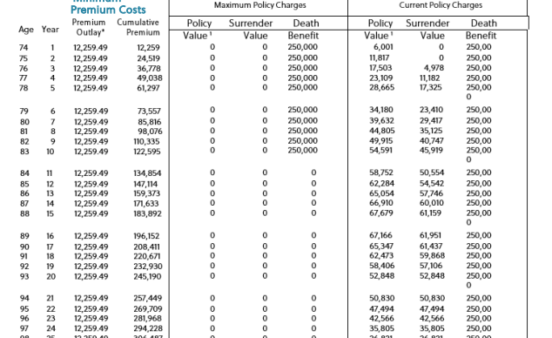

The legislation applies to policies with a cash value of at least $10,000 and non-guaranteed charges. It does not cover individual or group-annuity contracts or bank-owned or corporate-owned policies. For the eligible policies, the law would require insurers to:

- Inform customers of premium increases at least 90 days in advance

- Inform customers of any change to the interest rate on a policy’s accumulated value

- Provide policyholders with an illustration of all charges associated with their policy at least once a year

The bill’s sponsor, Texas Rep. Tom Craddick, was motivated by recent dramatic increases in cost of insurance (COI), especially for individuals with universal life policies. According to one report, Craddick himself had seen his premium on a variable UL policy jump more than 100 percent.

Rising COI, especially increases that are allowed to be implemented without full consumer disclosure, can erode the public’s trust in the industry and create an unnecessary burden for policyholders, many of whom are seniors trying to navigate retirement. The trend toward rising COI can also have an adverse effect on the life settlement industry, since higher COI can lead to higher costs for settlement providers.

Representatives of the settlement industry have spoken out publicly about rising COI and the need for state legislatures to act in the best interest of the consumer. In July 2018 at the annual meeting of the National Council of Insurance Legislators, Life Insurance Settlement Association Derwin Bayston asked the NCOIL to develop a model act for state lawmakers wishing to address COI increases as Rep. Craddick has done in Texas.

The resounding vote of confidence from the Texas House of Representatives (147-0 in favor of House Bill 207) reinforces a movement toward more robust consumer rights in every aspect of the insurance industry. On the life settlement front, policyholders are been granted more protection in recent years by emerging legislation requiring disclosure of the life settlement option and requiring more transparency about a policy’s costs, provisions and surrender options. Forty-three states currently have passed consumer protection regulations, and such laws are under consideration in other states as well.