Understanding Viatical Settlements

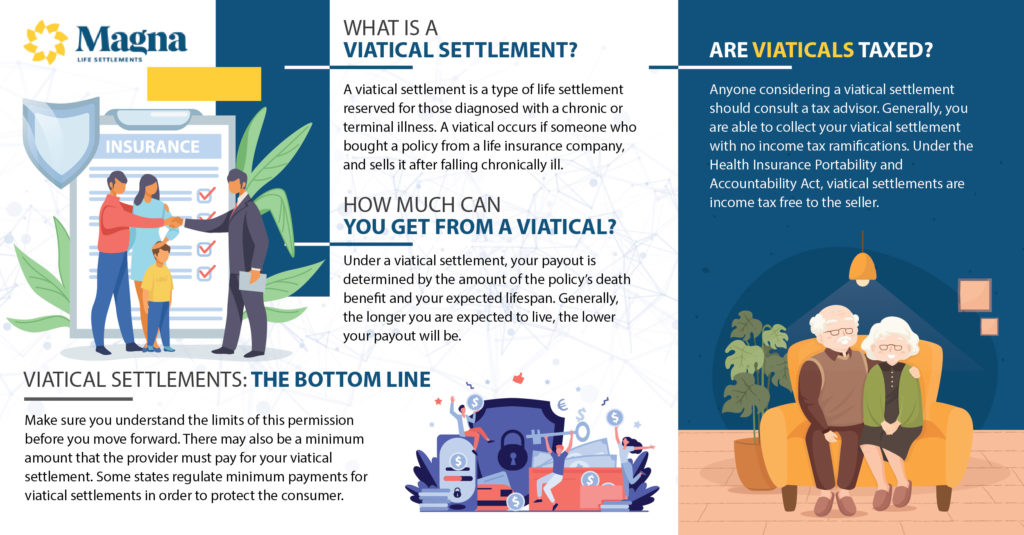

A viatical settlement is a type of life settlement reserved for those diagnosed with a chronic or terminal illness. A viatical occurs if someone who bought a policy from a life insurance company, and sells it after falling chronically ill.

The cash payout from a Viatical is tax free when used to cover certain health care expenses. Magna is one of the leading viatical settlement companies, and can assist you today.

See How Much Your Policy May Be Worth

A viatical settlement does not make sense for everyone, but for individuals in certain situations, it could provide a much-needed infusion of cash to help with medical or other expenses.

If you have a life insurance policy that you’re sure your beneficiaries will not need to rely on, and you are in need of a lump sum of money, a viatical settlement might be suitable.

It’s important to understand that the amount you receive in exchange for your life insurance policy can be significantly less than the policy’s death benefit. You’ll also want to discuss any potential tax implications with your tax advisor.

Selling your life insurance policy is a personal decision and there is no single correct answer. Below are some important factors to consider first:

- Are there any tax penalties for selling the policy?

- Are your beneficiaries aware of your need to sell your policy?

- Are there other ways to get the money you need for living expenses until you pass?

- Does your policy include a living benefit rider or an accelerated death benefit rider?

Magna Life Settlements Overview

Viatical Settlement Providers

Viatical and life settlement companies or individual providers need to be licensed or registered with a state’s department of insurance. Only 7 states in the U.S. are not regulated. Before selling your policy to a provider, be sure they are licensed or registered, where applicable, to legally buy your life insurance policy in your state as well as what the state’s requirements may be. This is important for many reasons, not the least of which is because it may play a big role in whether or how the sale of your life insurance policy is treated for tax purposes. In addition, you need to be certain if there are any other fees involved with the sale after you sell it. Always consult a professional when considering the sale of your policy.

Under a viatical settlement, your payout is determined by the amount of the policy’s death benefit and your expected lifespan. Generally, the longer you are expected to live, the lower your payout will be. This is because the viatical company will have a longer period during which they will make premium payments on the policy – reducing their profitability. You may be required to have a medical examination in order for the viatical company to estimate your expected lifespan.

Hearing the news that a loved one is facing a terminal diagnosis is stressful for everyone in the family, and unfortunately financial concerns can also come into play along with the prospect of impending loss. What are the options for a terminally ill senior facing mounting medical or care expenses? Can a life insurance policy be leveraged to help meet that need?

There are two different options allow a life insurance policy holder to get cash out of a life insurance policy that might not be needed anymore. Both viatical settlements and accelerated death benefits could offer financial relief to families facing a difficult diagnosis, but the two agreements are different in several key ways.

The amount you will actually receive is going to depend on a number of factors including how much your policy is worth, how much the company will spend on your insurance premiums, and your projected life expectancy. Typically, the longer you have left to live, the less you will be given for your policy.

Viatical Taxes

In a lot of cases, if you are terminally ill and have less than two years to live, you can sell your life insurance policy without any tax penalties. In other cases, if you have been diagnosed as chronically ill and not terminally ill, the funds you receive may only be tax free if you use them to pay for qualified long-term care services.

Again, always consult a professional if you have a policy you do not need or cannot afford, and you wish to realize its true value while you live.

We do our best to make sure our loved ones are cared for after we’re gone, and life insurance policies offer us one way to do that. But coming face to face with a terminal diagnosis can shift the tides and make a living benefit a better option than your loved ones collecting a death benefit.

When you sell your policy through a viatical settlement, your beneficiaries will not receive the life insurance policy payout upon your passing. Rather, the third party to whom you sold the policy becomes the owner and collects the full face value.

You do, however, receive a lump sum that exceeds the cash value while you are still living and you can use that money however you see fit.

Anyone considering a viatical settlement should consult a tax advisor. Generally, you are able to collect your viatical settlement with no income tax ramifications. Under the Health Insurance Portability and Accountability Act, viatical settlements are income tax free to the seller.

Accelerated Death Benefit

An accelerated death benefit (ADB) is a provision attached to some life insurance policies that allows consumers to borrow against the value of the death benefit in the event of a terminal illness. The ADB, which comes in the form of a cash advance, is generally tax-free if the expected life expectancy of the life insurance policyholder is two years or less.

According to Investopedia, individuals may be eligible for an ADB if they meet one of the following criteria:

- Diagnosis of a terminal illness with life expectancy of two years or less

- Diagnosis of any serious illness that will reduce expected life span

- Need for an organ transplant because of serious illness

- Enrollment in hospice care

In most cases, a life insurance policyholder who accelerates his or her death benefit to help defray expenses only borrows against part of the policy, leaving a reduced death benefit that is still available for the original beneficiary.

For example, if an individual with a $1 million life insurance policy needs funds for health care, he could borrow against half of that policy, receiving an offer of $265,000 cash against $500,000 of life insurance. That would leave $500,000 to go to his beneficiary upon his death.

Viatical Settlements: Bottom Line

There are viatical settlement requirements regarding the total value of your policy. In most cases, a policy must exceed $100K in face value to be eligible for a viatical settlement. Additionally, most states require that a policy must be owned for at least two years before a policyowner can sell it. Some states require ownership of a policy for five years.

In regards to health status, the third party provider who is interested in buying will require signed forms that allow them to get access to health information on your behalf.

Make sure you understand the limits of this permission before you move forward. There may also be a minimum amount that the provider must pay for your viatical settlement. Some states regulate minimum payments for viatical settlements in order to protect the consumer.

For example, Viatical settlements can offer meaningful, timely solutions for terminally or chronically ill patients in need of additional funds. Talk to your family about how a viatical settlement might help you and your family get on a firmer financial foundation during a time of need. Sometimes a living benefit today can outweigh the death benefit that will be collected someday.

Contact Magna Life Settlements today or use our Settlement Calculator to see how much cash your life insurance policy is worth today.

*Comments provided in this post are for informational purposes only and should not be construed as financial, legal or tax advice, recommendations or solicitations. Please consult your financial, legal or tax professional with questions related to the information presented, or for advice as to whether a life settlement is right for you.