Population Growth in Seniors Over 65 Indicates Progress in 3 Key Industries

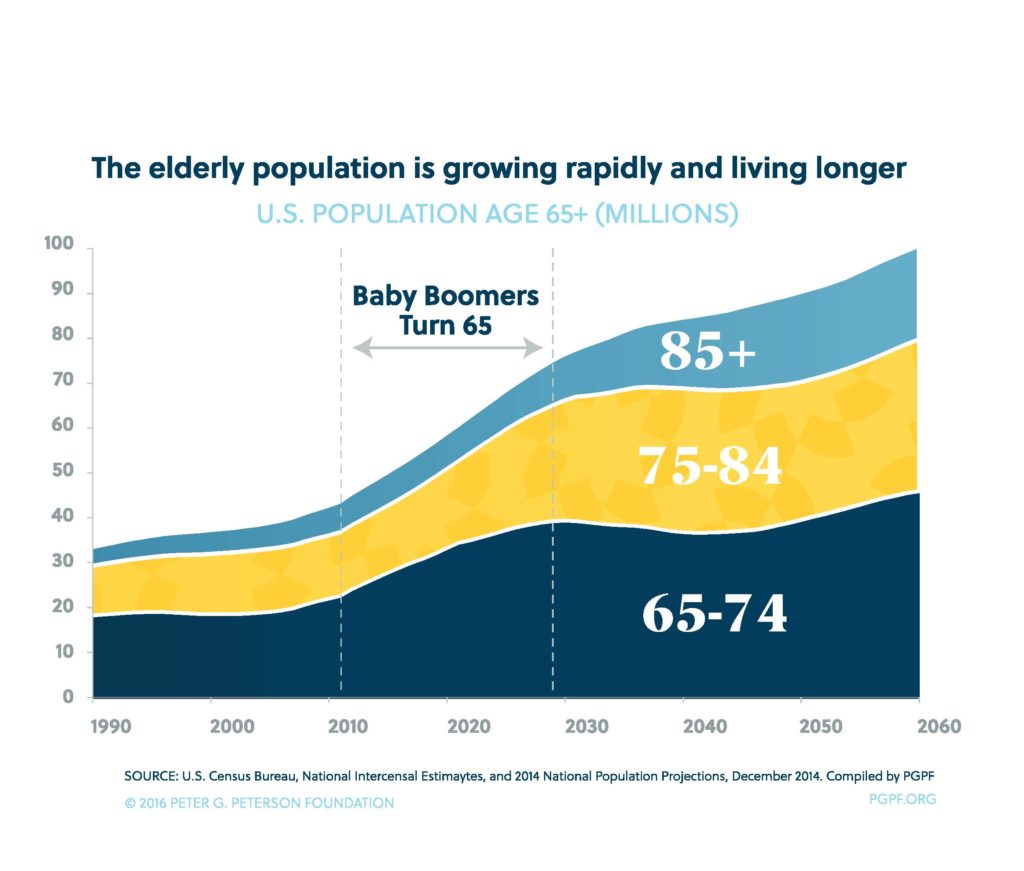

According to data collected in 2012 by the U.S. Census Bureau, the sector of Americans over the age of 65 is expected to double by 2050, comprising about 20 percent of the nation’s population. This trend of aging baby boomers will affect demand in a number of industries geared toward seniors. Specifically, the graying of America is affecting life settlements, healthcare and care giving.

What are the implications for advocates and professionals seeking to serve the growing needs of U.S. seniors?

Magna Life Settlements Overview

Three key industries and the projections for how they will keep pace with surging demand

Life Settlements

Every year more than 500,000 life insurance policies lapse, with the policy holder getting no financial benefit, while only 1,250 seniors choose to sell their policies for a life settlement. With the surge of people over 65 and the growing profile of life settlements as an option, companies that help seniors get top dollar for their life insurance policies are more responsive than ever. With minimal research, seniors can decide whether life settlement is right for them and find the right buyer without a middleman.

This direct-consumer relationship in life settlements will become more prevalent as more seniors see the benefit of turning their life insurance policies into income. The percentage of seniors opting for life settlements, now only a quarter of one percent, will grow along with the older population, especially since a recent study by the Insurance Studies Institute shows that 90 percent of seniors would have sought out a life settlement if they had been made aware of the option.

Healthcare

Even with the boom in the senior population still mostly in the future, health care facilities are reporting a shortage in caregivers trained specifically in geriatric care. As the over-65 population approaches the number of 83 million estimated by the middle of the century, this nation will have a pressing need for doctors, nurses and physician’s assistants who can care for the elderly, and home health care and preventative medicine for seniors will also grow exponentially.

The American Nurse’s Association estimates that by 2022 the U.S. will need more than one million new nurses to care for older Americans. And primary care medicine isn’t the only sector of the health care workforce that needs to intentionally address the coming influx of senior patients; there will also be a need for specialists like psychiatrists, optometrists and podiatrists who specialize in serving people in the over-65 bracket.

Caregiving

A surging population of seniors also means that this country will have more middle-aged adults than ever trying to care responsibly for their aging parents. Serving as a good advocate for elderly loved ones is complicated, and caregivers will need more education than ever to examine the options for financial planning, long-term care, healthcare and other key areas.

Life settlements, which can help seniors pay for healthcare or long-term care using profits from a life insurance policy that is no longer working for them, is one decision caregivers should learn about to help their parents navigate the often-murky world of senior adulthood.