What are life settlements?

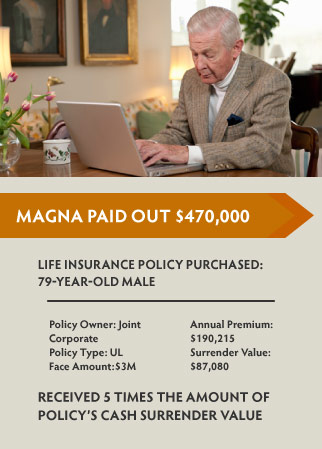

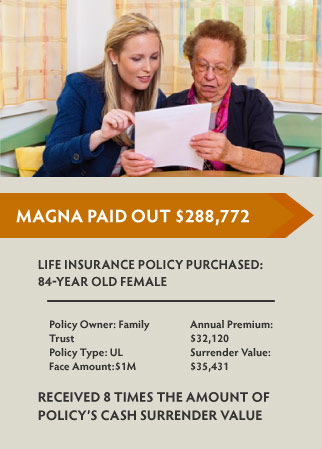

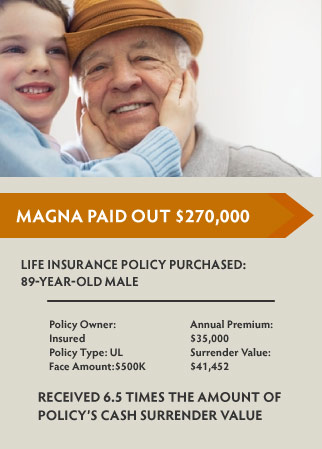

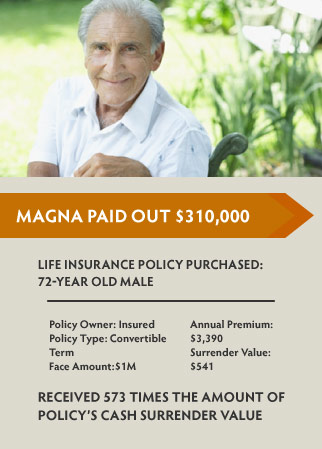

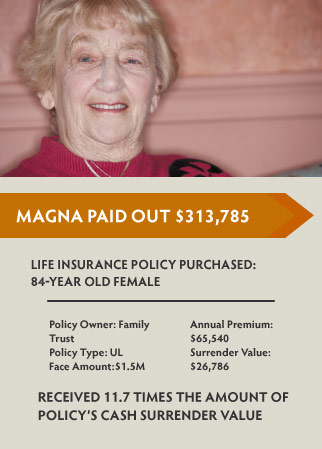

A life settlement is the selling of one’s insurance policy for a cash payment of less than the face amount but for more than the cash surrender value.

Why would someone want to sell their policy?

Reasons for selling a policy include (but are not limited to): Paying off debt, supplementing retirement income, changes to estate planning, getting rid of expensive premium payments, selling policy and using money from sale to obtain a policy with superior coverage. Due to changes in family circumstances, a life insurance policy owner may no longer need the insurance provided by the policy. A spouse may have died, children may have grown up, or a company with life insurance on a key officer may have been sold or gone out of business.

Are life settlements for me?

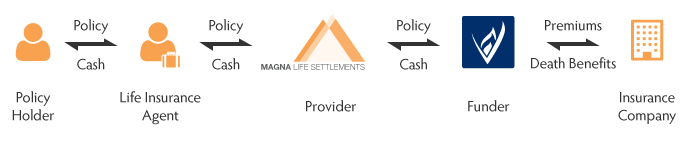

What is the life settlement process like?

What are the costs associated with a life settlement?

Magna takes no fee from you for selling the policy.

If you are retaining a life settlement broker, a fee, commission, or other form of compensation is often paid to your broker for: life settlement consultation, the cost of obtaining medical records and life expectancy reports. That fee is negotiated between you and your advisers.

How much is my policy worth?

The main factors for determining the value of a life insurance policy are the age and medical condition of an insured. Take our PYC questionnaire or contact us to find out if a life settlement is right for you. Be sure to checkout our Life Settlement Calculator to see the value of your Life Insurance Policy.

What happens to my policy after it’s sold?

You are no longer responsible for premium payments and no longer own the policy. You may be asked to update information regarding your health periodically.

Will my personal and medical information be protected?

Yes. Magna takes your confidentiality very seriously and all records are kept in accordance with state and federal privacy laws.

Are the proceeds of a life settlement taxable?

Life settlement proceeds may be taxable. You should consult your tax advisor for additional information.

Are life settlements legal?

Yes, the Supreme Court of the United States declared that your life insurance is personal property that can be sold, traded or even given away. Your life insurance carrier has no right to question or prevent you from doing this.

Am I obligated to sell my policy?

No. You are under no obligation to accept an offer. In fact, there is a 15 day rescission period that allows you to change your mind and not sell for up to 15 days after receiving payment for the policy in most states. The rescission period varies from state to state.

Can I keep a portion of the death benefit but not pay the insurance premiums?

Yes, that is known as a retained death benefit (RDB). Read our brochure and FAQ sheet.

Are life settlements the same as viatical settlements? What is the difference?

A viatical settlement involves an insured with a life expectancy of less than 24 months or as defined by the Department of Insurance for the applicable ownership state. If the insured has a life expectancy of more than 24 months or doesn’t meet the qualifications defined by the Department of Insurance, the transaction is considered a life settlement.